In this week’s issue of Circle of Competence (#142) (highly recommended), one of the shared reads was a white-paper from the Yale School of Management, On the Nature of Long-Term Holds [of business investments].

First off, I’m partial to the central thesis of the paper (best summated by the subtitle of the piece) which espouses that holding a business for the long-term is lucrative. I think that’s directionally correct. I also don’t think that most reasonably thoughtful people would disagree in any general way. It seems rather obvious. The questions I have is how the authors can miss illustrating the most important points when making such a blanket statement: the specificity of what business and for how long.

In the first couple pages, the authors (academic staff at Yale’s School of Management and The University of Chicago Booth School of Business) explain how they pose questions (in a thought experiment) to their students who are interested in becoming entrepreneurs and/or business operators after school. They ask their students to think of names of the wealthiest people they know in the region of the world they come from. Anecdotally, the professors overwhelmingly heard names of business owners or those that have owned a business that grew it in some way successfully over the long term.

The purpose of the authors’ exercise and paper is three-fold:

- To make the case that all great wealth has really been created by those who own material equity stakes in businesses,

- Encourage students to keep the businesses instead of selling/flipping because long term ownership confers transformational wealth to its owners,

- If you recognize 1 and do 2, you’ll compound wealth for the long term in some exponential way.

The rest of the paper gives some anecdotes where they contrast real and theoretical financial statements of businesses built over longer periods of time to support that even mid-market companies can consistently grow in the mid-teens CAGRs for years or even decades. There is a focus on the compound effects of using the inherent benefits of the corporate structure, tax minimization and perils of transactions costs/fees on being a drag on the effects of compounding.

Here’s where I think the white paper misses the mark:

On the Nature of … Survivorship Bias

Long-term ownership in a business can be lucrative — no doubt that is a compelling argument to make. Delay gratification, don’t spend your cash personally, let the profits compound in the corporate entity all sounds very … well … sound. That’s capital allocation and business operations 101.

What’s not spoken of enough (though the authors do provide some disclaimers throughout the article about what they are not considering in their thesis) is that the issue with being an operator in an active business is that it’s really, f^$&ing hard.

It’s easy to say, keep the cash and keep investing it and keep doing it year after year and it’ll grow in this exponential way in a couple decades, but that’s not always possible nor is the growth of it perfectly uniform (and up and into the right which this article only showcases) over the longer term.

In fact, it’s not possible for the majority of established businesses, let alone the added fragility of being a small / mid-market enterprise (this being the paper’s focus given their Search Fund students).

Survivability is far from guaranteed. In fact, the opposite is much more certain — death, decay, irrelevance is the norm in the (business) world.

Operating a business is akin to a knife fight, as Brent Beshore of Permanent Capital would say. Every day from wake to sleep is hand-to-hand combat, repeated daily.

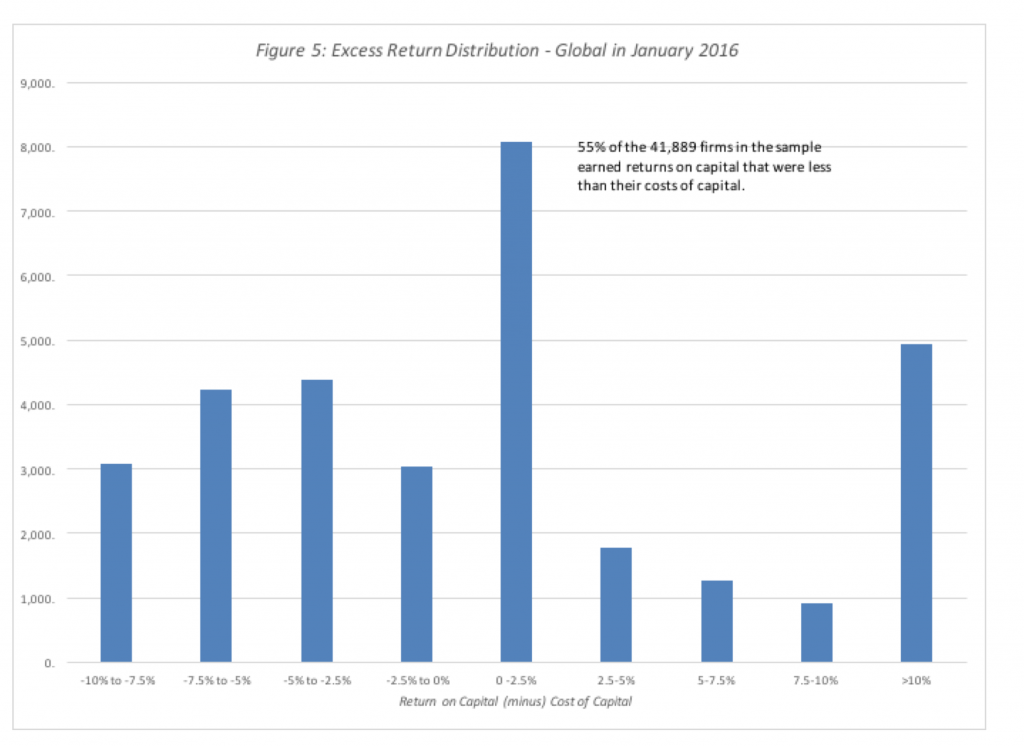

Of the group that does somehow survive and live to tell their stories, there’s a great majority of them that are just treading water (see figure below). Businesses that are on life-support (those that don’t even earn their cost of capital over the longer term) are likely not in a position to reap any of the benefits of compounding that this paper makes so easy. Entropy is the norm.

The Cost of Capital, Aswath Damodaran, NYU Stern

Steve Jobs said it best (though he might have used it for a different purpose), that you can only connect the dots looking backward. It’s easy to summarize and look back at the insurance company from Connecticut that the authors reference about how they achieved a CAGR of 14% since 2000. What’s not highlighted enough (and more likely than not), is that these results were achieved by way of blood, sweat and tears. It may look easy on paper and only in hindsight. Their success was not guaranteed in any way looking forwards.

My response to this Yale School of Business white paper is not to say that us builders shouldn’t be thinking about constructing something that lasts nor that our preference (should we be so lucky to be able to even have a choice) should be anything but the long term. What I am saying is that just because something has lasted, does not inherently make it possible, particularly interesting or informative to unilaterally follow a major capital allocation decision like selling a company (or not).

On the Nature of … Higher Order-Level Effects

I agree with authors when they say that:

“Being a material owner in a superb business is a rare opportunity.”

Authors of this article

No doubt it’s rare.

Said another way, it’s likely that > 98% of the future operators and students of these authors would never come across such a business from their search. But let’s say by some luck and fate they do and its available for them to purchase. (Remember, a superb business is rare!) It stands to reason that it’s likely that the purchase conditions on the business will be prohibitive. A great business for sale in an auction will command a big ticket price; that’s the expected second-order effect. Yet I don’t think the authors had spent the time making the connection of their idealistic examples to the real-world conditions of the business marketplace by discussing these higher-order level effects. Rather, the paper focused naively on the first-order ones in isolation by neglecting to highlight the high costs and high hurdle (and highly lucky outcome) of purchasing a business of this quality.

But there’s something even more obvious that was missed; it’s not likely that the current owners of great/rare businesses would be putting their businesses up for sale in the first place. Why the hell would anyone part with a goose that lays golden-eggs?!

Everything in business is hard and not easily won. If it were easily won, then the market will find those advantages and exploit them via the proverbial invisible hand.

This is not lost by the authors themselves, at times. By their own account, great businesses are hard to come by. And judging how rare an event that is, the great majority of their search fund students-turned-operators are likely relegated to run mediocre businesses. That’s just the statistical norm.

By error of commission, by the time these new owners realize first-hand that the business is not worth turning around or continuing operations or any number of reasons (since it is so rare!), they will likely auction it for sale. (This is also what the authors suggest as the best course of action!) In which case, this white paper isn’t even applicable to the majority of search fund prospects (though they don’t know it yet) nor is it instructive for those business owners who need encouragement by the authors to “stick around” when in fact they should be doing the opposite to cut their losses instead.

On the Nature of … Return on Incremental Capital

The examples given in the paper has chosen only from a pool of representative businesses that:

- Has survived the perils of the cut-throat business marketplace;

- By some luck one was able to find and purchase a rare (quality) business at a fair price.

What does a new owner-operator do now?

If you read the examples in the paper, you’d think that the only option is to “stick with it” and keep reinvesting in the same business. Why not? Keep the cash, keep using it (to minimize taxes) and keep investing it. Don’t worry, it’ll grow over time — you’ll see!

But here, the authors also missed an opportunity to discuss the nuances of what would be accretive growth and what likely will be destructive. And this gap makes it seem to the readers that there are no downsides to reinvestment and that the only function of compounding growth is the amount of time one sticks with it.

That is not true and is overly simplistic.

One of the major reasons why great business are so rare is that they possess structural advantages by having an incredible runway for reinvestment. First, they may (and likely) require a lot of capital (in which case it makes it easier for the operator to make the choice to reinvest or not do something stupid). Secondly, the return on the incremental dollar is also equal to or even better than investments up to that point in time. That, in a nutshell, is why compounding works so marvellously in the first place!

The converse is also illustrative because without avenues for similar or better returns than the past, the business asymptotes. Every new dollar one put into the business doesn’t return that dollar or more back. When that happens, over time and overall, the magic of compounding that the paper worships, is not possible even with the best of businesses. Consistently profitable yes, but not compounded.

That’s to say that, capital allocation decisions are more complex than just following a general tenet of: keep investing for the long term. It’s not at all that simple even if one was able to find these rare breeds.

In reality, the likely and only guarantee following a simple buy-and-hold-for-the-long-term strategy just for sake of it (and without consideration of any other relevant factors, higher-level order effects and metrics-focused capital allocation strategies), is that it’s going to end in tears. The paper’s arguments would have been better served by discussing the expected experience and outcome of the majority of their students: how the rarity of quality businesses means that one need only focus on the highest quality ones by discarding the rest, paying a fair price for it and the psychology of how to hold on to them (even when it’s hard), not by illustrating (the obvious and self-explanatory) general proof that ownership in a quality business can make you fabulously rich. (Duh!)

Perhaps this is what Charlie Munger says when he refers to: “People calculate too much and think too little.”

Nick Sleep also has something to say on this matter:

“So much [business] commentary espouses certainty on a multitude of issues, and so little of what is said is, at least in our opinion, knowable. The absolute certainty in the voice of the proponent so often seeks to mask the weakness of the argument. If Zak and I spot this, we metaphorically tune out. In our opinion, just a few big things in life are knowable.”

Nicholas Sleep, Nomad Investment Partnership Letter June 30th, 2009

I’ve tuned out.