In the past few years, I’ve come around to this mental model that the economic value of tech businesses are not easily calculated when looking just at public financial reports/filings (10k, 10q, annual reports etc.) at face value.

Perhaps it never was and still requires a skilled analyst to decipher.

Though I think tech businesses are somewhat different.

There’s many opinions on this, from the Founder-led CEOs themselves, to investors like Cathy Wood (of Ark Invest) who talk about innovation now becoming necessary, undervalued and mainstream. I particularly like Cathie Wood’s mental model that we are in another type of “industrial revolution” and that we all might need to revisit business and investments in that light to better capitalize on these future technologies becoming present solutions.

Another proponent of this way of thinking is Kai Wu from Sparkling Capital. I keep an eye out for their monthly white papers on topics pertaining or business and investing and in particular tech investing.

In one of the papers, “A Human View of Disruption”, Wu analyses whether tech companies have a strategic advantage if they hire talent who have the skills of the future, AI, data science, machine learning etc.

I think it’s very compelling that modern monopolies (as Alex Mozaed calls them) and modern companies with a lot of tech actually have a different measure of capital. Gone are the days that it comes from assets (i.e. railroads) but it’s human capital that is most important when it comes to staying ahead. Wu lays that out nicely in various white papers including the on quote above.

One thing to add to Wu’s work is this: if human capital is necessary to stay ahead of the curve and over competitors, then one the metrics that I think may be very interesting as a lagging indicator of how much human capital is retained versus the scale of the business to extract from the markets based on the talent.

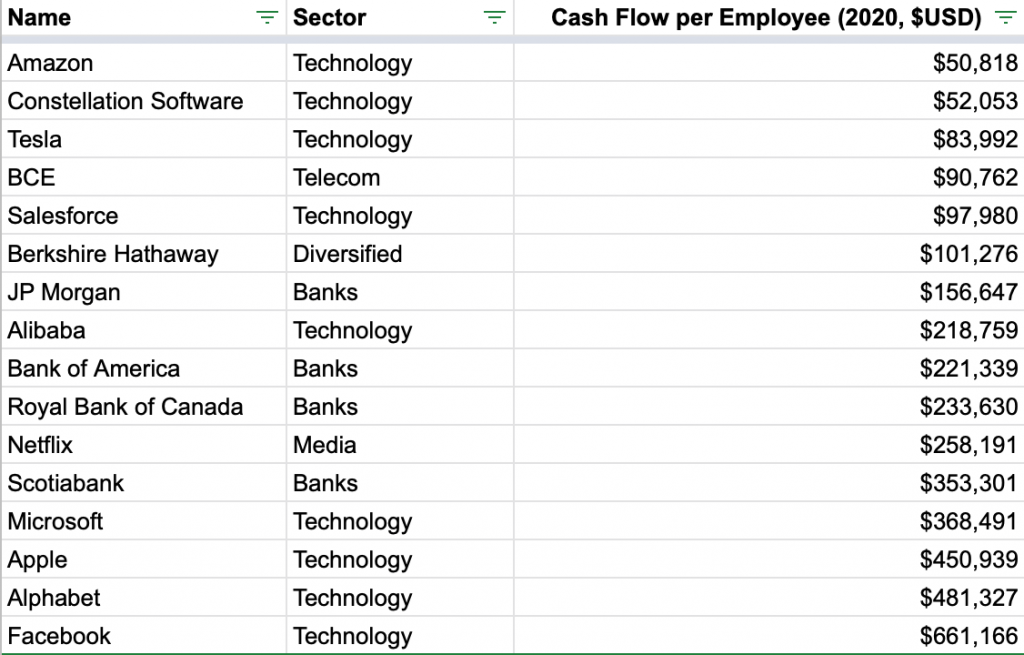

The metric I’ve compiled is based on ratio between:

- Operating Cash Flow : # of Employees

Here’s the list below.

Some it’s not at all surprising. Scale is an advantage and they are very very asset-light businesses. Some are very fascinating to see that as a company they are successful but not very cash generative (per employee and not yet anyway). A few observations from this very limited set and very limited look at just at the end of their respective fiscal 2020s:

- Banks are in the middle of the pack.

- Technology or tech-enabled companies aren’t always human capital-light as they span the gamut. Just take a look at Constellation Software versus Microsoft. It is very interesting to me that. (More analysis on that later).

- This metric alone doesn’t tell much about the viability of the business or the longevity of the business. It does show to me how asset-light they can be, how efficient they are in using their companies assets and people to drive business outcomes.

- Not surprisingly is that the FAANG are the top of the pack when it comes to Cash Flows generated by each employee.

Underlying data from Statista.com and QuickFS.net