Inspired by Josh Brown’s collection of essays from notable people in finance, How I Invest My Money, as well as other of DIY personal finance bloggers out there, I’d also like to showcase how I invest.

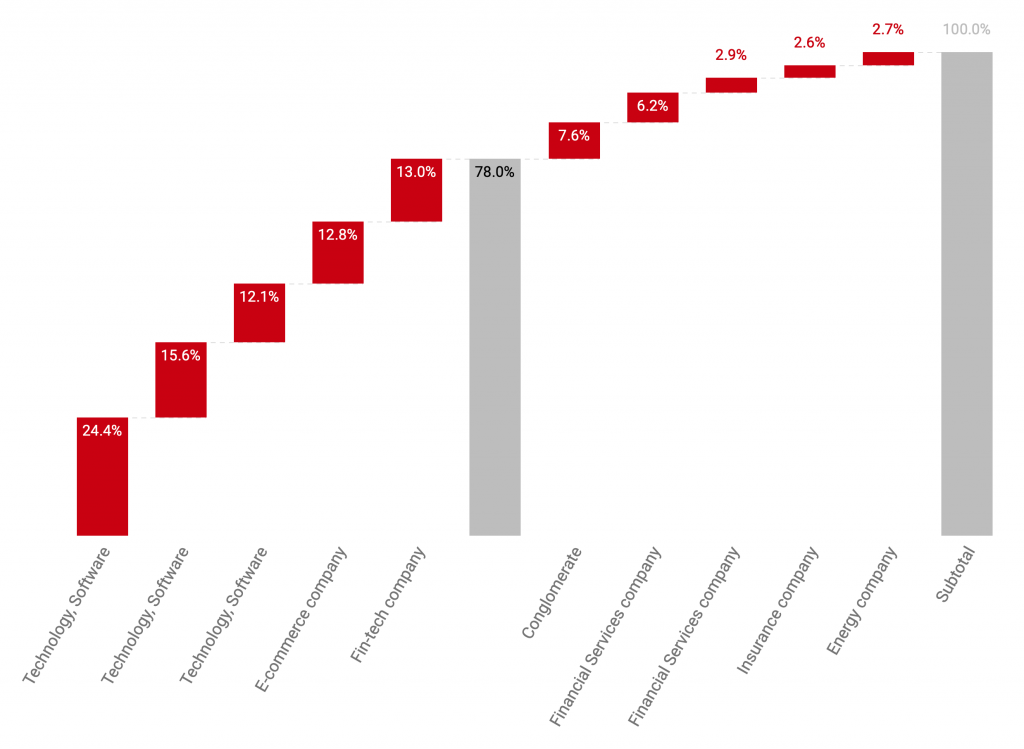

All securities, who shall remain nameless, are shared by their primary business and arranged (roughly) from the largest positions to the smallest. In future posts, I’ll go into why I’ve structured it like this and the checklists I’ve used to how I have allocated in the way that I have done.

It might look incredibly stupid or incredibly interesting (or both) but it’s as much a way to reflect back my own thesis and thinking as well as just wanting to share.

Here it is!

Here’s some notes and reflection of what I’ve shared above:

- I have full control and direct this investable portfolio.

- I don’t hold any fixed income, bonds or alternative investments; firstly because I don’t fully understand them and is not within my circle of competence and secondly I’m fairly young and think equities is the way to have an out-sized return given the longer time horizon.

- All holdings is in equities. Common stocks on major exchanges primarily in North America.

- None of them are funds — mutual or exchange-traded.

- I don’t really hold any international or emerging market stocks because I don’t know them well and because I feel like these companies I own have their business affairs abroad already. If I were to guess I would think that these companies do ~35% of their business in aggregate ex-North America, if not more.

- Close to 80% of my investable assets are in my top 5 bets.

- The top bet is a quarter of my entire portfolio!

- This top bet has been on my radar (for a decade) and portfolio for close to 6 years. I would gladly hold forever if similar conditions remain (i.e. compounding).

- Technology and a subset of that, software, is where I feel like my circle of competence is. Within that, SaaS-type software is where I understand best given my own experience having built a SaaS business and having a career in software businesses.

- Financial services is the second highest category largely because of where my career has taken me. It could also be incredibly dumb of me to think I have an upper hand in this category but it’s probably generally within my circle of competence. It’s also what I think is in an above-average industry.

- None of these holdings are from employee share programs I’ve participated in the past.

- This portfolio rarely holds cash, but this is not taking spare cash into account (which I have next to nil, typically).

I’ve also only done this analysis recently, even though I’ve had a portfolio for the past decade at least. Like Mr. Munger, I’m not afraid of having big positions if I really truly know the company. In fact, this is the most diversified it has been in the last 5 years and there are some non-portfolio reasons for this (to be discussed in later posts.)

I’m also learning about the “coffee can” portfolio (where I first heard of the concept from Focused Compounding from Andrew Kuhn and Geoff Gannon, thanks!) in which I buy a new company every year/period and just hold them forever. I think I’m more or less already doing that.

Lastly, whatever funds I do have, I’d gladly add to any of these companies at their current valuations and also pray they go lower. (In fact, I’ve increased my largest position most recently and happy to have done it.) I know them very well at this point and welcome the opportunity to buy them at a discount. However, my current plan is to add more additional capital to the companies that have lower allocations in the portfolio so that over time the largest positions don’t become too imbalanced. 😉